Medicare Advantage plans offer an alternative to Original Medicare . You will get your Part A and Part B benefits through your Medicare Advantage plan. Most Medicare Advantage plans also include Part D prescription drug coverage, as well as other benefits such dental, vision, hearing and fitness. They often include a specific network of doctors and health care providers you can use to get care, sometimes at lower costs than with other types of health plans. Learn more about eligibility for Medicare Advantage plans.

UMR insurance coverage generally offers a broad range of behavioral health benefits, including inpatient and outpatient drug rehab. Depending on your policy, your benefits may also extend to cover inpatient detox, IOP, and/or partial hospitalization programs. Our admissions team can verify your health insurance benefits through UMR to determine your out-of-pocket cost for rehab. Since UMR isn't an insurance company, no drug and alcohol rehab coverage is offered directly through UMR. However, there are over 3,000 health care providers within the UMR third-party network.

UMR specializes in working with each provider to expand the variety of mental health opportunities available to clients, including rehabilitation for substance abuse. UMR recognizes the effectiveness of rehabilitation and encourages providers to offer fair coverage. For more information on getting rehab coverage, call your insurance provider. One thing to remember is that UMR is not an insurance provider, so this company will not directly cover the expenses related to your health care. However, you may be able to get coverage through your insurance policy. UMR can work with you, helping to negotiate coverage for mental health services.

They can work with customers and insurance companies to get the best coverage for the individuals who are in need of treatment. You may be wondering about your UMR substance abuse treatment coverage. You don't have to worry about being denied for a substance abuse issue.

The extent of coverage varies depending on the type of policy and tier level you choose. UMR will work with you to find the best way possible to offer confidential, fast, and effective assistance to employees in need of assistance. The amount of coverage you have can vary widely based on your state of residence, whether the facility is in- or out-of-network, the length of your stay, and your insurance plan level. The cost of drug and alcohol addiction treatment will vary from person to person and will also depend on the rehab center, the type of program attended, and specific services received. In 2010, then-President Barack Obama signed into law the Affordable Care Act . Prior to the signing of the bill, insurance companies would typically choose not to cover drug rehab costs under the guise of such treatment being elective.

Under the new law, healthcare insurance carriers are required to cover drug rehab treatment costs the same way they would cover any other type of medical intervention. If you have a healthcare insurance policy as an individual or through your employer, Insurance will cover at least a portion of your drug rehab costs. Although UMR is not a health insurance company, the organization can work to help you find coverage for your addiction detox and treatment expenses. UMR is known for reliability and may offer you the help you need in order to get treatment for substance abuse. Also, our team of experts can give you a detailed report based on our complimentary review of your insurance policy. Dual special needs plans (also called dual health plans or D-SNPs for short) are for people who qualify for both Medicare and Medicaid.

A dual health plan works together with your Medicaid health plan. The City offers two medical plan options to meet your individual needs. Both plans include free preventive care services (with in-network providers only) and a four-tier prescription drug plan.

It's worth noting that some insurance companies will cover aftercare costs related to ongoing outpatient counseling to help prevent relapses. If you are not clear about the extent your insurance company will cover your drug rehab costs, you have several options. You should be able to find the information on your insurance coverage summary page. If you cannot find the answers you seek, you can contact a customer service representative at the insurance company. If you would prefer, the drug rehab facility should have administrative staff who would be willing to contact your insurance company and verify Insurance on your behalf.

That's a big help — especially for people who have complex medical needs. It makes it easier to manage your doctors, specialists and care services. Medicaid is a health care program that's managed at the state level by each state government. However, state governments do not actually provide health insurance. State governments contract with private insurance companies like UnitedHealthcare to provide health coverage for beneficiaries of Medicaid and other government health care programs.

Our government-sponsored health plans operate under the name UnitedHealthcare Community Plan. Again, this would vary a great deal from one healthcare insurance policy to the next. As a general rule of thumb, insurance companies will cover outpatient treatment for as long as your therapist prescribes it. As for residential or inpatient care, you can expect coverage for at least the first days.

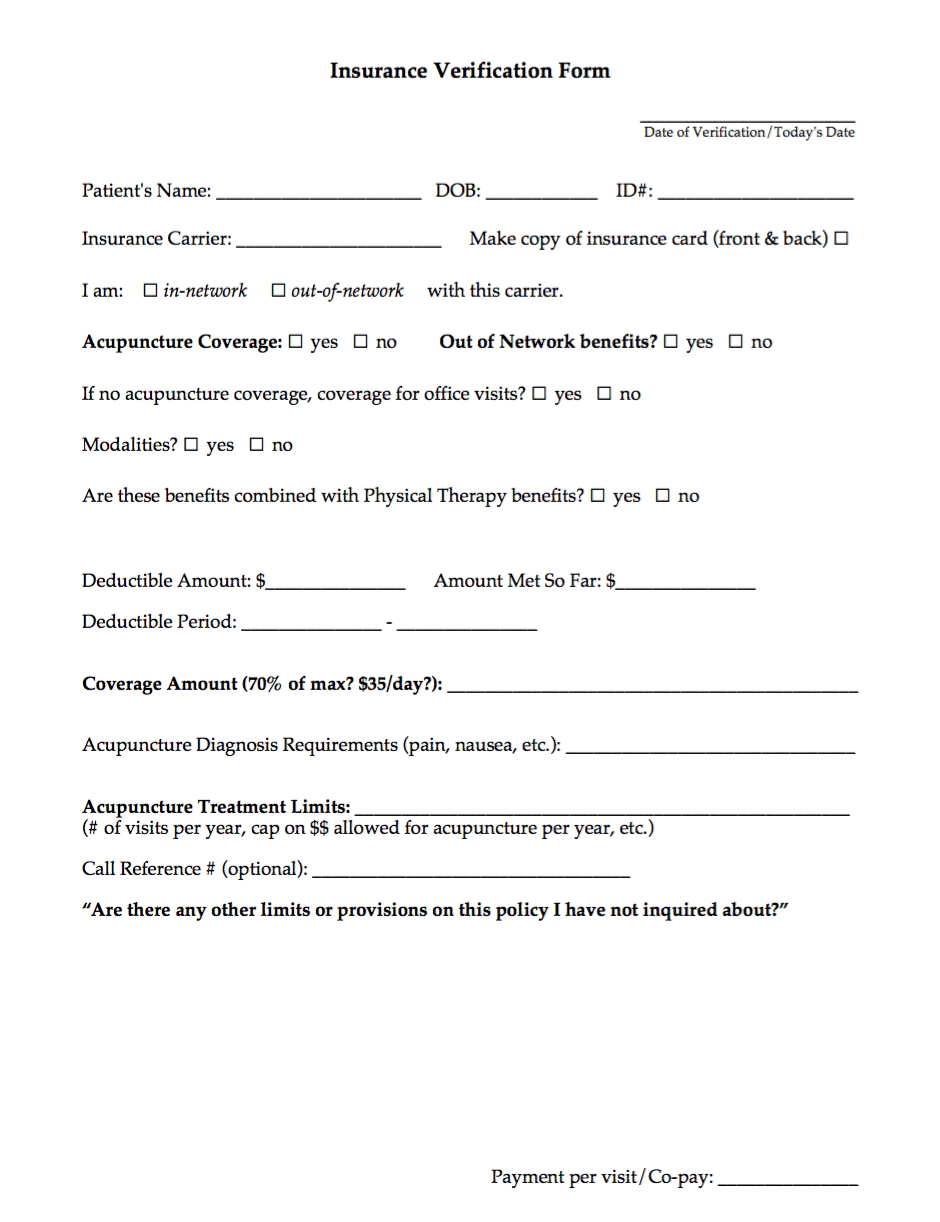

If your therapist were to recommend extended treatment of up to 180 days, you would want to confirm with your insurance company whether or not they would continue coverage. Sometimes, it can be difficult to know whether your insurance will cover inpatient addiction treatment, outpatient programs, or both. In many cases, insurance companies will want to determine which kind of treatment is medically necessary and the length of time a person needs to remain in treatment. Some believe that insurance companies require individuals to pay a copay and/or deductible before the company contributes to the payment for treatment. University of Utah Health contracts with most major health insurance carriers and transplant networks.

Intensive outpatient programs may be covered by your insurance policy. The details of your policy will help determine the exact requirements for coverage in an intensive outpatient treatment program. In many cases, intensive outpatient care is offered to an addicted individual at the beginning of recovery. While specifics may vary by employer policy options and the plan you chose for your needs, an insurance company will usually cover between 60 and 80 percent of in-network provider services. The coverage for out-of-network services may differ based on your situation and the type of policy you choose.

The amount of coverage you have for Massachusetts drug rehab through an insurance provider who works with UMR depends on the policy you select. Your employer may offer a few different policies through a company like UnitedHealthcare that allows you to choose different levels of coverage based on your specific concerns and goals. At True Self Recovery in Arkansas, we offer free insurance verification for our clients who feel they need some help. When you contact us, we will carry out the thorough analysis of your addiction problem, and then recommend a workable UMR drug treatment program.

How To Read A Umr Insurance Card Next, we will contact your insurance provider on your behalf and verify your benefits. We will also let you know if you will be responsible for any out-of-pocket expense not covered under your plan. ", know that we are able to work with UMR, as well as other major insurance providersto help you pay for your treatment. Most people who have UMR as their insurance claims processor have excellent behavioral health benefits. The best ones are the ones that include multiple types of services in the field of addiction treatment. Is a "third-party administrator" who your employer hires to ensure your claims are paid correctly, which keeps health care costs low for you and your family.

UMR is not a health insurance company — they are a part of United Health Care . UMR is a medical management service that streamlines the process of caring for your health. UMR is not an insurance company, but rather, a provider network that allows people to be treated by their own doctors. The UMR third-party network includes over 3,000 participating healthcare providers. If you have UMR as your insurance claims processor, you are most likely covered for drug and alcohol rehab.

Depending on your insurance policy, your benefits may cover all or a portion of the cost of treatment at Nova Recovery Center. Benefit-eligible employees have the option of choosing between three health insurance plans. The only differences between our plans are the premiums, deductibles, copays and coinsurance.

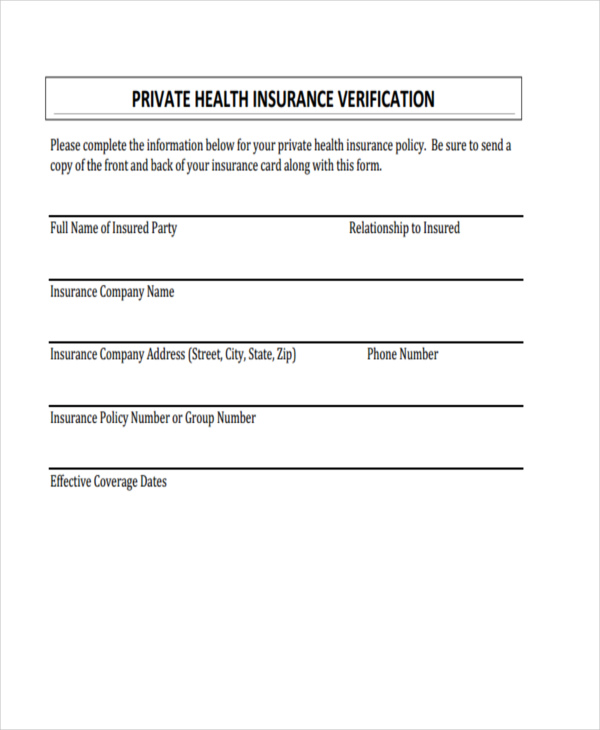

HonorHealth accepts most insurance plans at its hospitals and provider offices. However, just because a plan is listed, doesn't mean you are covered; there are some exclusions. It's important that you contact your insurance carrier to verify your coverage before you seek services. Labcorp will file claims for insured patients directly to Medicare, Medicaid, and many insurance companies and managed care plans.

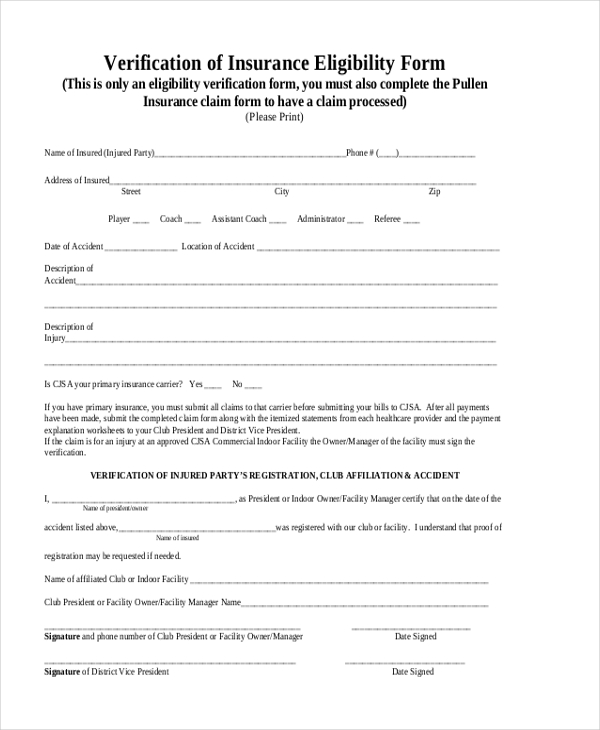

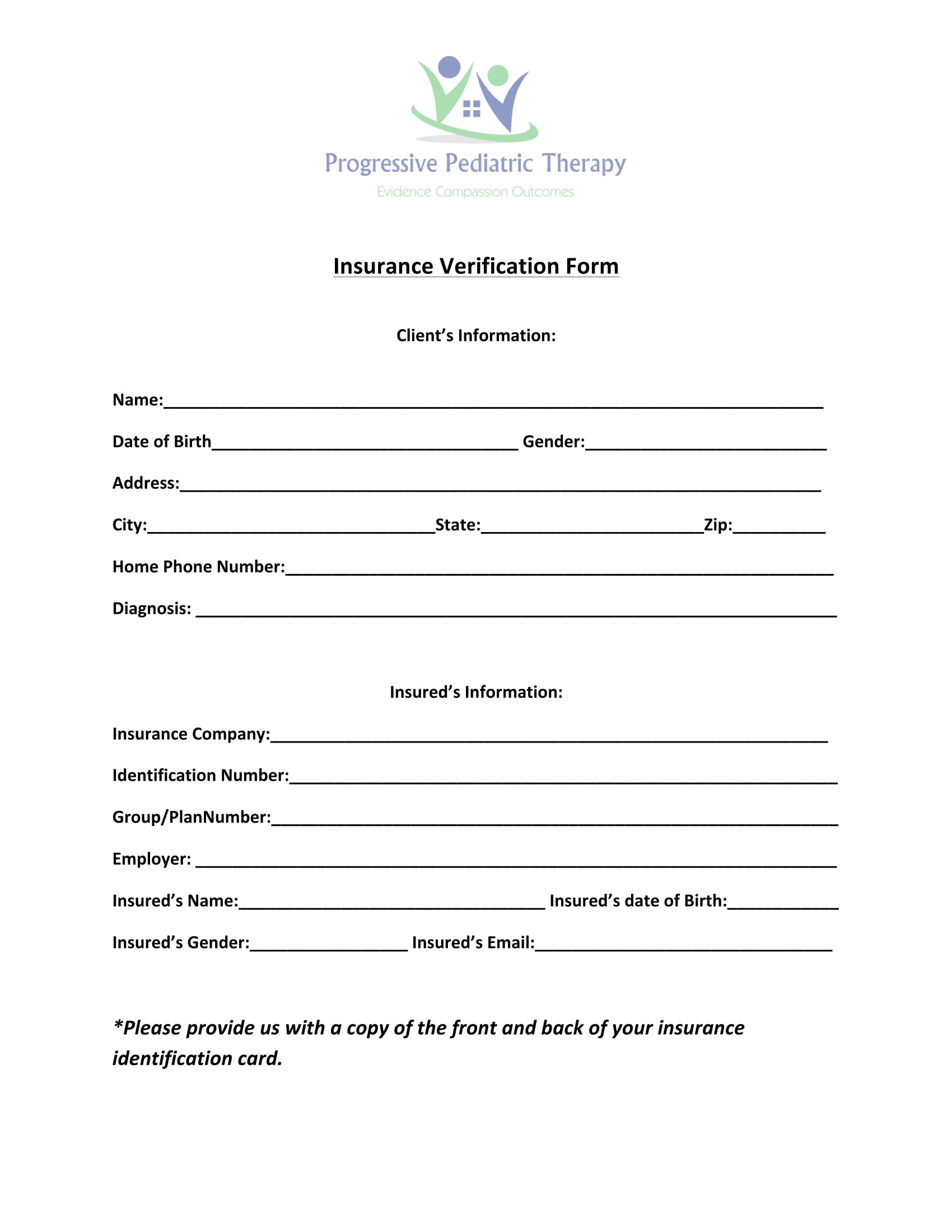

It is always important to verify and update insurance information and know which testing laboratories are in-network or participating providers for your benefit plan. The extent of your coverage will depend on the parameters of your insurance policy. Through the insurance verification process, you should be able to find out the coverage percentages for each of the appropriate addiction treatment options. The applicable percentages should be the same offered for other standard medical treatments, though there could be treatment limitations assigned in any given treatment category. Since UMR is a third-party administrator for the insurance provided by your employer, you can verify your coverage through UMR or your health insurance provider. You can also contact Spring Hill Recovery Center to clarify the details of your policy as it applies to rehab services.

Coverage for inpatient treatment or residential treatment through UMR-administered policies differs based on the details of your plan. In most cases, a portion of the cost is covered by insurance providers who work with UMR services. UMR is a third-party company, or TPA, that your employer hires to ensure that your claims on a healthcare policy are handled correctly. It is not an insurance provider; however, it is a UnitedHealthcare company and works with your insurance policy to help you focus on health and addiction recovery goals. Our plans have benefits at a reduced level when you receive care from out-of-network providers. Please keep in mind that you have to meet your out-of-network deductible before the plan will pay.

Even if you've met your deductible with an in-network provider, you have to meet it again with an out-of-network provider. You will also be billed for charges in excess of the Usual & Reasonable reimbursement paid by the plan. Prior-authorization is required for all out-of-network services. UMR is a branch of UnitedHealthcare and a third-party administrator that manages claims for other companies. The company offers national healthcare network discounts, advanced claims control, and other flexible benefits to almost 4,000 customized plans. It allows self-funded employer groups to lower medical costs and achieve benefit goals all while improving the health of their employees.

Fountain Hills Recovery is Arizona's top-rated luxury drug and alcohol addiction treatment program. We focus on an individualized approach providing specialized treatment including dual-diagnosis. In order to better serve you, we've developed relationships with major insurance companies including UMR.

UnitedHealthcare offers a wide variety of products, including individual health insurance available on state marketplaces, while offering great customer benefit programs. However, the added benefits come with increased premiums that make UHC policies one of the premier policies on exchanges. Spring Hill Recovery Center can help with your goals of addiction recovery by assisting with your plans for treatment.

For more information about rehab services or to find out more details about your specific insurance policy, contact Spring Hill's helpline today. You can expect three primary types of expenses when working with your insurance provider. If you are looking at a treatment that is not covered by your policy, then you may also have additional costs for drug and alcohol treatment from the additional treatments. The out-of-pocket costs for rehab in Massachusetts differ based on your policy. An insurance company that works with UMR may set different standards for out-of-pocket expenses based on the type of policies your employer offers and the specific plan you select. It is also important to note that UMR provides its clients with certain discounts on in-network health services with United Healthcare's PPO Network is utilized.

They also offer more than 100 other partner networks that employer insurance plans can utilize. Cigna ACA/Insurance Marketplace plans are NOT in-network with U of U Health facilities and physicians. Please check with your benefits department or call the customer service number on the back of your insurance card to find an in-network provider. Finding the best psychiatrist to help manage your mental health can often be intimidating at first. Your insurance company may offer a long list of potential providers, but how do you know if they are any good ?

At Horizon Behavioral Medicine, we believe the role of a psychiatrist goes beyond medication management. Not only are our clinicians highly trained, our entire team is also committed to providing you with exceptional service and care. You'll find our team to be warm professionals, who excel at communicating and connecting with people.

The length of UMR drug treatment is between you and your admissions navigator. They will provide a recommendation about what treatment program will be most helpful for your situation and how long it will take. The amount of time your UMR benefits will cover varies depending on what type of policy you have. The NIDA recommends a minimum of 3 months for substance abuse issues.6You can call the number on the back of your card or look up your plan information to find more information.

Your employer pays the portion of your health care costs not paid by you. While UMR does not directly offer treatment coverage as they are not an insurance company, their network of healthcare providers do. To learn more about your UMR coverage for drug or alcohol treatment, contact Addiction Treatment Services today.

We can leverage your insurance policy to help you enroll in a high-quality, cost-effective rehab program that promises long-lasting, positive results. For the most part, insurance companies want to confine customers from getting standard variations of inpatient treatment. Since some of the more modern forms of therapy carry additional costs, insurance companies are under no obligation to cover such costs. Those who need help treating mental health concerns along with addiction may be unsure about their options and how their insurance can help cover the cost of treatment. If you're in this situation, you may be feeling overwhelmed, struggling to find answers to your questions and concerns.

But, we can help you to sort through the details of your insurance information, figuring out what is covered and how much money you will need to pay out-of-pocket for treatment. In many cases, people who struggle with addiction also have mental health or behavioral health challenges. When people have co-occurring disorders, it's commonly known as a dual diagnosis. Those who are living with mental illness combined with addiction should receive care and treatment that deals with both issues, not just one. Coverage for sober living facilities may vary based on the program and the details of a policy. Since a sober living facility may be considered transitional treatment when it offers outpatient and other treatment plans, it may be covered in some circumstances.

It may also be considered a form of housing, so a policy may not cover the costs. In most cases, insurance policies that UMR administers and manages offer coverage for outpatient rehab services. You may have a set copayment for the treatment as well as coinsurance costs that apply to the situation. Some policies may require precertification before you are able to seek outpatient treatment.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.